Here’s a stat that’ll make you think twice about skipping travel insurance for Italy: over 40% of travelers to Italy file some type of insurance claim during their trip.

That’s nearly half of all visitors! And all of them have one question is Italy safe for travel?

In this guide, we’ll cover the best travel insurance for Italy , what coverage you actually need, and how to avoid the mistakes that cost me both money and peace of mind.

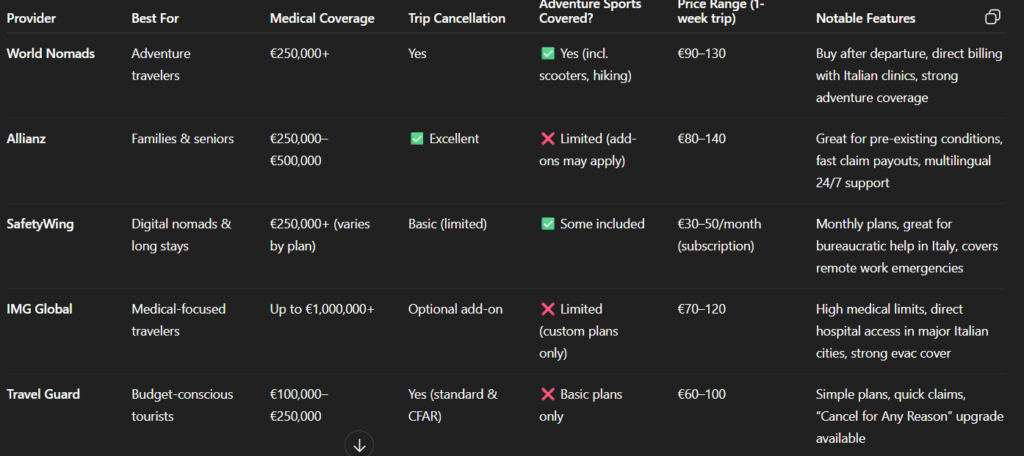

Top 5 Best Travel Insurance Companies for Italy

After dealing with claims in Italy personally and talking to dozens of other travelers, I’ve narrowed down the best options. These aren’t just random picks – they’re companies that actually deliver when you need them most in Italy.

1. World Nomads: The Adventure Traveler’s Best Friend

World Nomads gets my top spot because they understand how people actually travel to Italy these days.

What sets them apart is their flexibility. You can buy coverage even after you’ve left home (as long as you’re not already in Italy), and they cover tons of adventure activities that other companies won’t touch.

I used them when I rented a Vespa in Tuscany – something that would’ve voided most standard policies.

Their Italy coverage is particularly strong for medical emergencies. They have direct billing arrangements with major Italian hospitals, which means you don’t have to pay upfront and wait for reimbursement.

When my hiking buddy twisted his ankle badly near Cinque Terre, World Nomads had him seen at a private clinic within two hours, and we never saw a bill.

The downside? They’re not the cheapest option, typically running 10-15% more than basic coverage. But for active travelers, the peace of mind is worth every euro.

2. Allianz: The Family-Friendly Powerhouse

What makes Allianz perfect for Italy family trips is their comprehensive trip cancellation coverage.

Italian schools often have strikes that can affect educational tours, and Allianz covers these kinds of disruptions that other companies might not.

They also have excellent coverage for pre-existing medical conditions, which is crucial for traveling grandparents.

Their baggage coverage is particularly good for families.

When another family I know had their stroller and car seat lost by the airline, Allianz reimbursed them for emergency replacements within 24 hours.

They even covered the upgrade to better gear.

The customer service is available 24/7 in multiple languages, and they have people who actually know Italy well.

When I called them about coverage for a cooking class in Bologna, the rep knew exactly what I was talking about and confirmed coverage immediately.

3. SafetyWing: The Digital Nomad Solution

SafetyWing might seem like an odd choice for Italy, but hear me out.

If you’re planning an extended stay or working remotely from Italy, they’re unbeatable.

Their monthly subscription model means you can stay covered for months at a time without the crazy costs of extending traditional policies.

Traditional travel insurance would’ve cost me over €400 for that duration. SafetyWing covered the same period for €150, and the coverage was actually more comprehensive for long-term stays.

They’re particularly good at handling the bureaucratic side of Italian healthcare.

When I needed to see a specialist in Florence, SafetyWing’s local assistance team helped me navigate the Italian healthcare system and even translated medical documents.

Try getting that kind of service from a traditional insurer!

The coverage extends to 180+ countries, so if you’re planning to explore other parts of Europe during your Italy stay, you’re covered everywhere.

Plus, they cover trip interruption for work-related emergencies, which most policies exclude.

4. IMG Global: Medical Coverage Champions

IMG Global isn’t as well-known as the others, but they’re absolute pros when it comes to medical coverage in Italy.

Their Patriot Travel Medical plan is specifically designed for international travel, and they have some of the highest medical coverage limits I’ve seen.

What impressed me most was their network of providers in Italy.

They have direct relationships with major hospitals in Rome, Milan, Florence, and Naples, which means faster treatment and no upfront payments.

When a colleague had a severe allergic reaction in Milan, IMG had him at Ospedale San Raffaele within 30 minutes of his call.

Their emergency evacuation coverage is top-notch too.

They don’t just cover medical evacuation – they’ll also evacuate you for political unrest or natural disasters. During the earthquake activity in central Italy a few years back, they evacuated several clients as a precautionary measure at no extra cost.

The plans are highly customizable, so you can adjust coverage limits based on your specific needs and budget.

5. Travel Guard: The Budget-Conscious Choice

Travel Guard (now part of AIG) rounds out my list as the best budget option that doesn’t completely sacrifice coverage quality. They’re not fancy, but they get the job done for basic Italy travel protection.

I’ve used Travel Guard for shorter Italy trips where I wasn’t planning anything too adventurous.

Their basic plans cover all the essentials – medical emergencies, trip cancellation, baggage loss, and emergency evacuation.

What I like about Travel Guard is their straightforward approach. No confusing policy language or hidden exclusions – what you see is what you get.

Their claims process is also pretty painless. When I had to file a claim for delayed baggage in Rome, it took about 10 days to get reimbursed, which is reasonable.

They offer several plan levels, so you can upgrade if you need higher coverage limits or additional features.

Their “Preferred” plan includes cancel for any reason coverage, which can be valuable for Italy trips given the potential for strikes and other disruptions.

Essential Coverage Types for Italy Travel

After years of traveling to Italy and dealing with various mishaps, I’ve learned exactly what coverage you can’t afford to skip. Let me break down the must-haves based on real experience, not just insurance company marketing.

Emergency Medical Coverage: Your Non-Negotiable Foundation

Here’s the thing about medical coverage in Italy – you need way more than you think.

The minimum I recommend is €100,000, but honestly, €250,000 is better if you can afford it.

I learned this when a friend needed emergency appendix surgery in Rome.

The surgery itself was €8,000, but the complications and extended hospital stay pushed the total bill to over €25,000.

Italian hospitals are excellent, but they’re not cheap for foreigners.

Even routine emergency room visits start at €400-400, and that’s just the consultation.

Add any tests, X-rays, or treatments, and costs multiply quickly. I’ve seen tourists get shocked by €600 bills for what they thought would be simple check-ups.

Trip Cancellation and Interruption: Italy’s Strike Reality

Italy’s strike culture is real, and it will affect your trip at some point.

I’ve been caught in airline strikes, train strikes, museum strikes, and even garbage collector strikes that made parts of Naples pretty unpleasant.

Your insurance needs to cover trip interruption due to strikes, civil unrest, and labor disputes.

The coverage should include both your prepaid, non-refundable expenses and additional costs for extended stays.

When a train strike stranded me in Florence for an extra two days, trip interruption coverage paid for my hotel extension and rebooking fees. Without it, I would’ve been out €400.

Look for policies that cover “Cancel for Any Reason” if you’re worried about changing your mind.

This typically costs 40-60% more, but it gives you the flexibility to cancel up to 48 hours before departure and recover 75% of your costs.

Baggage and Personal Belongings: Theft-Focused Protection

I recommend at least €2,500 in baggage coverage, with specific provisions for theft and mysterious disappearance.

Make sure the policy covers items stolen from your person, not just from hotel rooms or locked cars.

Personal belongings coverage should extend to electronics, jewelry, and travel documents.

Replacing a stolen passport in Italy involves embassy visits, fees, and often delayed travel plans.

Good coverage will reimburse both the direct costs and additional expenses caused by document replacement delays.

Emergency Evacuation: When Italy Can’t Handle Your Emergency

Medical evacuation coverage is where many people skimp, and it’s a huge mistake. Evacuation from Italy to your home country can easily cost €50,000-100,000, depending on your condition and the type of transport required.

I witnessed this firsthand when an American tourist had a serious mountain climbing accident in the Dolomites. The helicopter rescue alone cost €15,000, and the air ambulance flight to Germany (the nearest facility equipped for his injuries) was another €35,000. His insurance covered everything, but without it, his family would’ve faced bankruptcy.

Make sure evacuation coverage includes both medical necessity and repatriation of remains. Nobody wants to think about worst-case scenarios, but Italian bureaucracy around death certificates and body repatriation is complex and expensive. Proper coverage handles all of this without putting additional stress on your family.

How Much Does Travel Insurance for Italy Cost?

Let me give you the real numbers based on actual quotes and purchases I’ve made for Italy trips over the years. The insurance industry loves to speak in percentages of trip cost, but I’ll break it down in actual euros so you know what to budget.

Average Cost Breakdown by Trip Length and Coverage

For a basic €2,000 Italy trip lasting one week, expect to pay €60-100 for decent coverage. That’s about 3-5% of your trip cost, which is pretty standard for European travel insurance. But here’s where it gets interesting – the coverage quality varies dramatically within that price range.

Budget policies (€60-80 range) typically offer €50,000-100,000 in medical coverage, basic trip cancellation, and minimal baggage protection. These work fine if you’re young, healthy, and doing standard tourist activities. I used budget coverage for a basic Rome-Florence-Venice trip and felt adequately protected.

Mid-range policies (€80-120 range) bump medical coverage to €250,000-500,000, include better theft protection, and often cover some adventure activities. This is my sweet spot for most Italy trips. The extra €20-40 buys significantly better peace of mind.

Premium policies (€120-200+ range) offer maximum medical coverage, cancel-for-any-reason options, and comprehensive adventure activity coverage. For expensive trips or adventure travel, the premium is worth it. When I planned a €4,000 Italian Alps climbing trip, the €180 premium policy saved me from potentially catastrophic costs.

Factors That Affect Your Premium

Age is the biggest factor in Italy travel insurance pricing. Once you hit 65, premiums jump dramatically. A 70-year-old can expect to pay 200-300% more than a 30-year-old for identical coverage. If you’re traveling with elderly parents or grandparents, budget accordingly.

Pre-existing medical conditions add significant costs but are often worth covering. When my dad (who has heart issues) wanted to join a family trip to Italy, the pre-existing condition waiver added €150 to our family policy. But given Italian medical costs, it was essential coverage.

Trip cost directly affects premiums since trip cancellation coverage is based on your total expenses. A €5,000 luxury Italy tour will cost more to insure than a €1,500 budget trip, even with identical medical coverage limits. But percentage-wise, expensive trips often get better insurance value.

Activities are huge premium drivers. Basic tourist activities (museums, restaurants, walking tours) don’t affect pricing. But add skiing, scuba diving, or mountain climbing, and premiums can jump 50-100%. Adventure sports coverage is where insurance companies make their money.

Money-Saving Tips Without Compromising Coverage

Buy early, but not too early. Most companies offer early bird discounts if you purchase within 10-21 days of making your first trip payment. But buying months in advance isn’t necessarily cheaper and limits your ability to adjust coverage as plans change.

Consider annual policies if you travel internationally more than once per year. Annual multi-trip policies cost €200-400 but can cover unlimited trips up to 30-45 days each. For frequent Italy visitors, this beats buying individual trip policies.

Increase deductibles to lower premiums. Most policies offer €100-500 deductible options. Choosing a €250 deductible instead of €50 can save 15-20% on premiums. For healthy travelers unlikely to make claims, higher deductibles make financial sense.

Bundle with other insurance if possible. My credit card’s travel insurance wasn’t comprehensive enough alone, but their partnership discount saved me 10% on a World Nomads policy.

Single Trip vs Annual Policy Economics

The math on annual policies is pretty straightforward. If you take more than one international trip per year, or one trip longer than 30 days, annual coverage usually costs less than individual trip policies.

For Italy-focused travelers, annual policies make special sense because they eliminate the rush to buy coverage for spontaneous trips. Italian flight deals pop up regularly, and having year-round coverage means you can book immediately without insurance shopping delays.

However, annual policies often have trip length limits (usually 30-45 days) and may not cover the highest-risk activities. If you’re planning extended stays or adventure activities, individual trip policies often provide better coverage even if they cost more.

The break-even point for most travelers is about 1.5-2 trips per year. If you’re taking one Italy trip plus any other international travel, annual coverage typically saves money while providing better convenience and often superior coverage.

Why You Need Travel Insurance for Italy

Let me paint you a picture of why travel insurance for Italy isn’t optional anymore.

During my second trip to Venice, I witnessed a fellow American tourist get his wallet stolen right on the Rialto Bridge.

The guy looked devastated – not just because of the money, but because his entire trip was essentially ruined without his cards and ID.

The reality is that Italy has some unique risks that most travelers don’t think about until it’s too late.

The EU Healthcare Reality Check

Here’s something that shocked me: even though Italy has excellent healthcare, being a tourist means you’re not covered under their national system.

When I got sick in Rome, I discovered that even basic emergency room visits start at €200-300, and that’s before any tests or treatments.

A simple broken bone can easily run €1,500-2,000 out of pocket.

I talked to a nurse at Policlinico Umberto I in Rome who told me they see uninsured American tourists every week who are completely blindsided by medical costs.

She said the most expensive case she’d seen was a tourist who needed emergency surgery after a scooter accident – the bill hit €15,000.

Italy-Specific Travel Risks

Italy throws some curveballs that other European destinations don’t. First, there’s the infamous transportation strikes. I’ve been caught in three different strikes during my Italy trips – train strikes, airline strikes, even taxi strikes. Each time, it meant unexpected hotel nights and rebooking flights.

Then there’s the theft situation in major tourist areas. Rome, Naples, and even parts of Florence have organized pickpocket operations that specifically target tourists. I watched a group of kids work the Spanish Steps like it was their job – because it basically is.

Natural disasters are another factor people don’t consider. Plus, flooding in Venice and landslides in coastal areas happen more frequently than most travelers realize.

The Real Cost of Going Uninsured

Let me break down what “going bare” actually costs when things go wrong in Italy. Medical evacuation from Italy to the US averages €25,000-50,000.

Trip cancellation due to strikes or natural disasters can mean losing €2,000-5,000 in non-refundable bookings.

Even replacing stolen luggage and documents can easily hit €500-1,000.

The math is pretty simple: a comprehensive travel insurance policy for Italy typically costs 4-6% of your total trip cost.

For a €2,000 trip, that’s €80-120 for complete peace of mind.

Italy-Specific Travel Insurance Considerations

Traveling to Italy isn’t like going to other European countries – there are unique factors that can make or break your insurance coverage. I’ve learned these lessons through experience, conversations with local contacts, and unfortunately, some expensive mistakes.

Schengen Area Requirements: The Legal Minimums

If you need a visa to enter Italy, you’re legally required to have travel insurance with minimum coverage amounts.

The Schengen requirements mandate €30,000 in medical coverage, but here’s what the guidelines don’t tell you – €30,000 isn’t nearly enough if something serious happens.

I helped a family from India who had exactly the minimum required coverage. When their teenage son broke his leg badly in a skiing accident in the Italian Alps, the €30,000 limit was exhausted within the first day of treatment.

The family ended up paying over €15,000 out of pocket for surgery, rehabilitation, and extended hospital stay.

Even if you don’t need a visa, following Schengen minimum requirements is a good starting point, but definitely not the ending point.

The visa officers don’t care about coverage quality – they just check that you meet minimum amounts. Your actual travel safety requires much more thoughtful planning.

The insurance must be valid for the entire Schengen area and cover emergency medical care, urgent medical attention, and emergency hospital treatment.

It also needs to cover repatriation for medical reasons, urgent medical care, and emergency hospital treatment in case of death.

Make sure your policy explicitly states Schengen compliance if you need it for visa purposes.

Theft Protection in Tourist Hotspots: The Real Threat

Italy’s theft situation in tourist areas is more sophisticated than most travelers realize.

This isn’t random crime – it’s organized, targeted, and specifically designed to exploit tourists. Your insurance needs to account for this reality.

The Spanish Steps, Trevi Fountain, and areas around the Colosseum in Rome are particularly bad. Naples train station is notorious for organized pickpocket groups.

Even in Florence, the area around the Duomo sees constant theft attempts. I’ve watched tourists get robbed and not even realize it until hours later.

Standard theft coverage often has limitations that don’t work for Italian tourist scenarios. Some policies require visible signs of forced entry for theft claims, but pickpocketing leaves no such evidence.

Others exclude theft from your person while in public places, which is exactly where most Italian theft occurs.

Look for policies that specifically cover pickpocketing, purse snatching, and theft from your person in public areas.

The coverage should include immediate emergency cash advances if your wallet and cards are stolen.

When this happened to friends in Rome, their insurance company arranged emergency cash within two hours, which saved their entire trip.

How to Choose the Right Italy Travel Insurance

After helping dozens of friends and family members choose Italy travel insurance, I’ve developed a systematic approach that actually works. Forget the generic online comparison tools – here’s how to find coverage that fits your specific Italy travel plans.

Step-by-Step Process for Best Travel Insurance for Italy

Start with your activities, not your budget.

I see too many people choose insurance based on price alone, then discover their planned activities aren’t covered. Make a list of everything you plan to do in Italy – museums, restaurants, hiking, skiing, scooter rentals, cooking classes, whatever.

This activity list drives your coverage needs more than any other factor.

Next, assess your existing coverage. Many travelers have some protection through credit cards, health insurance, or homeowners policies. Turns out they had decent trip cancellation coverage but terrible medical benefits. This research helped me buy supplemental coverage instead of duplicate coverage.

Consider your risk tolerance honestly.

Are you the type who worries about everything that could go wrong, or do you generally assume things will work out fine?

High-anxiety travelers should invest in comprehensive coverage with cancel-for-any-reason options.

Laid-back travelers can often get by with basic medical and emergency coverage.

Questions to Ask Insurance Providers

Don’t just read policy documents – actually call the insurance companies and ask specific questions about your Italy trip. Here are the questions that have saved me from coverage gaps:

“If I rent a Vespa in Tuscany and have an accident, am I covered?” Standard policies often exclude motorized vehicle accidents, but some companies cover low-power scooters. Get this in writing if scooter rental is in your plans.

“What happens if a transportation strike extends my trip by three days?” Strike coverage varies dramatically between companies. Some cover only the strike’s direct